Friday, December 19, 2008

Jobs/Services

Tuesday, December 2, 2008

New Recruitment of Clerical Staff in State Bank of India

Last date for deposit fee at branch: 27-12-2008

Last date for On-line registration: 31-12-2008

Date of Written Examination: 01-03-2009 (Sunday)

Complete Detail is given in below link

Recruitment in State Bank of India

Result Middle and Secondary September 2008 , Board of School Education Haryana Bhiwani

As per Board of School Education Bhiwani

Middle 1 st Semester (Regular)

Middle 1 st and 2nd Semester (Private)

Matric (Secondary) 1 st Semester (Regular)

Matric (Secondary) 1 st and 2nd Semester (Private)

Friday, November 28, 2008

Med Result in MDU

Thursday, November 27, 2008

Result of BCA (Regular & DDE) July 2008 Exam, Mdu (Maharshi Dayanand University, Rohtak

Result Link of BCA Regular & DDE is as under

Wednesday, November 26, 2008

Tuesday, November 25, 2008

Date Sheet of B.E/B.Tech 1st to 8th Sem. Dec. 08- Jan. 09 MDU (Maharshi Dayanand University ,Rohtak)

Monday, November 24, 2008

Guru Gobind Singh Indraprastha University, Results

Result of M.Tech.(ECE) Weekend Programme, Batch 2007

2nd Semester

21-11-08

Revised Reaapear Result of B.Tech.(ECE), Batch 2001

2nd Semester

21-11-08

Revised Reaapear Result of B.Tech.(ECE), Batch 2003

6th Semester

21-11-08

Revised Result of B.Tech.(ECE), Batch 2004

8th Semester

21-11-08

Revised Reaapear Result of B.Tech.(ECE), Batch 2005

4th Semester

21-11-08

Revised Result of B.Tech.(ECE), Batch 2005

6th Semester

21-11-08

Revised Reaapear Result of B.Tech.(ECE), Batch 2006

2nd Semester

21-11-08

Revised Reaapear Result of B.Tech.(CSE), Batch 2004

2nd Semester

21-11-08

Revised Reaapear Result of B.Tech.(CSE), Batch 2003

6th Semester

21-11-08

Revised Result of B.Tech.(CSE), Batch 2005

6th Semester

21-11-08

Latest Movie Download and Enjoy

Bsnl Landline Phone Meter Reading (Dial 1661) & Toll Free Numbers

Procedure to Know your current Meter Reading of Your Bsnl Land Line Phone Number

- Just dial phone number 1661(one six six one)

- Computer will confirm your Land Line Telephone Number

- After that , your meter reading will be informed to you in twice or more.

Toll Free Numbers:-

- Bsnl Land Line = Dial 1500

- Bsnl Broad Band = Dial 18004241600

Result of BBA (II and DDE) of Maharishi Dayanand University, Rohtak Declared

Saturday, November 22, 2008

Friday, November 21, 2008

MCA/MBA/BE Date Sheet (December 2008) of Maharshi Dayanand University, Rohtak

Date sheet of MCA Dec. 2008 of 1st, 3rd or 5th Semester of Maharshi Dayanand University Rohtak (Haryana) is Available below

Thursday, November 20, 2008

Indian Postal Forms

1 Application for Opening of an Account (Saving/RD/TD(1/2/3/5 year)/MIS)

2 SB Deposit Chelan SB-103

3 RD Deposit Chelan SB-103a

4 SB Withdrawal Form SB-7

5 Application for availing the facility of Cheque System SB/CQE-4

6 Application for fresh Cheque Book for Savings Account SB/CQE-4a

7 Application for Nomination or Cancellation or variation of Nomination SB-55

8 Letter of Authority to be produced by the agent transacting business on behalf of anilliterate/blind/physically handicapped depositor in the Post Office Savings Bank SB-3(a)

9 Application for transfer of Account SB-10(b)

10 Application for the purpose of availing the facility of automatic transfer fromSavings Account to RD Account(s) SB-83

11 Application for the transfer of Post Office TD Account as security SB-13(a)

12 Claim under the Scheme of Protected Savings

13 Claim application form for settlement of Savings Bank Account of the deceased depositorwhere the claim is preferred on legal evidence of heirship.

14 Claim application form for settlement of the claim to a Savings Bank Account of thedeceased depositor where nomination has been registered with the Post Office

15 Claim application form for settlement of the claim to a Savings Bank Account of thedeceased depositor where nomination has been registered with the Post Office

16 Claim application form for settlement of Savings Bank Account of the deceased depositorwhere the claim is preferred on legal evidence of heirship.

17 Bond of Indemnity SB-25

18 Bond of Indemnity SB-25 Annexure-4

19 Post Office Savings Bank/Savings Certificate claim application where nonomination exists or legal evidence is not produced SB-84

20 Application for opening a Public Provident Fund Account under the Public Provident FundScheme 1968

21 PPF Deposit Form

22 Application for continuance of account under Public Provident Fund Scheme, 1968 beyond 15years

23 Nomination under the Public Provident Fund Scheme, 1968

24 Cancellation of Variation of Nomination previously made in respect of Account No………….under Public Provident Fund Scheme, 1968

25 Application form for withdrawal under the Public Provident Fund Scheme, 1968

26 Application form for a loan under the Public Provident Fund Scheme, 1968

27 Application for withdrawal by Nominees/Legal Heirs under the Public Provident Fund Scheme,1968

28 Application for issue of Duplicate Passbook SB-41

29 Application for Opening of an Account under Senior Citizen's Savings Scheme 2004

30 Application for Extension of an Account under Senior Citizen's Savings Scheme 2004

31 Pay-In-Slip for Deposits under Senior Citizens Savings Scheme 2004

32 Application for Nomination/Change/Cancellation of Nomination under Senior Citizens Savings Scheme 2004

33 Application for Closure of an Account under Senior Citizens Scheme 2004 by spouse (Joint Holder)/ Nominee(s) Legal Heirs

34 Application for Closure of Account under Senior Citizens Savings Scheme 2004 by Spouse (Joint Holder)/Nominee(s)/ Legal heirs

35 Pay-in Slip for Deposit Account under Senior Citizens Savings Scheme

36 Application for Automatic Transfer of Interest in TD to RD

1 Application for purchase of National Savings Certificates (VIII Issue) NC-71

2 Application for Transfer of Post Office ................. Certificates from one Post Office to another NC-32

3 Application for the issue of Duplicate Savings Certificate in lieu of the loss, theft, destruction, mutilation ordefacement of the Savings Certificates in the custody of the Holder NC-29

4 Application form for nomination under Section 6 of the Government Savings Certificates Act, 1959 NC-51

5 Form of Application for Cancellation or Variation of Nomination previously made in respect of Savings Certificates under Section 6 of the Government Savings Certificates Act 1959 NC-53

6 Application for transfer of National Savings Certificates as Security NC-41

7 Application of Transfer of Savings Certificates from one person to another (Except as Pledge) NC-34

8 Form of Application for purchase of Kisan Vikas - Patra (By Direct Investment) - NC-69(a)

9 Form of Application for purchase of Kisan Vikas Patra (By Investment through Agents NC-69(a1)

10 Application for the issue of Duplicate Savings Certificates in lieu of loss theft, destructions, mutilation or defecement of the Savings Certificates in the custody of the holder

11 Claim application form for settlement of Savings Certificates of the deceasedholder where the claim is preferred on legal evidence of heirship.

12 Claim application form for settlement of Savings Certificates of the deceasedholder who died on …………….. where nomination has been registered withPost Office.

13 Bond of Indemnity NC-61

14 Bond of Indemnity NC-54

15 Bond of Indemnity NC-54(a)

Form 16A from FVU

Now, No requirement of Microsoft Office Excel

Video Help--->>>>>>>>>>>>>>

Utility of This Software

- You will not have to spent extra time in generation of form 16a

- With in minimum period your forms 16a will be created

- Accuracy of forms based upon your uploaded Data

- There are options to change in Pan Numbers when you have uploaded pan with PANNOTAVBL.

- Two deductees should not have PANNOTAVBL. If there are you should change it as unique.

- For getting next/new screen you should press CTR+W .

Procedure of Installation:-

First of all you should install it in C:\ drive .

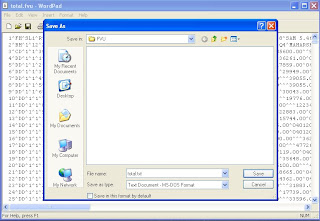

After that place fvu files in fvu folder= \e-tds\fvu\. Name of Fvu files should be Q1.fvu, Q2.fvu,Q3.fvu, Q4.fvu. If you have not Q4.fvu , You should rename available fvu file as Q4.fvu.

For example. You have only Q1.fvu file , then you should rename it as Q4.fvu. after that you will be able to create form 16a directly.

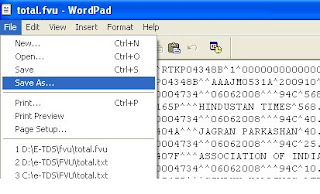

After clicking the 16a.exe file , The following screen will be displayed at your monitor.

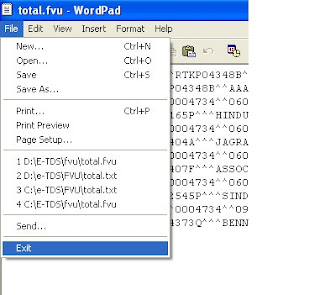

Picture-3

Now Click on Exit from the Word Pad as shown In Picture -3

At present your programme is minimized, Click on minimized e-tds or press CTR+enter to restore your programme.

Now a screen will be displaed having list of Pan Numbers = Pannotavbl, you will have to correct these numbers otherwise all pannotavbl will be grouped and will print as a single form 16a for all PANNOTAVBL.

Means if there are two deductee of Pannotavbl , form 16a for both deductee will be same.

After that you can save this with pressing CTRL+W or CTRL+end.

Now a next screen will be displayed for Tan Holder Data available in FVU file. If there are some corrections (Tan,Pan,Address,Name of Deductor,Designation, Place and date of Issue of form) , you can change it Here.

Now your forms are ready in output folder as Disp.prt file , you can print your forms directly in dot matric printer or with the help of MS word in Laster/Inket Printer.

for printing in laser/inket printer - open ms word and select file available in \e-tds\output\disp.prt and set margin as below

Top= 0 , Right = 0 and Bottom =0 and save

Now you can get it print in Laser/Inket printer.

Consultancy Charges for Software:-

Single User/One Tan Holder = Rs. 500/- one time. for 16a Generator

( Delivery :- Through email via rkj_zen@yahoo.co.in , Minimum with in 2 working days.

Support:-

Through email at rkj_zen@yahoo.co.in

or

Ph No. 09896124627 (Time 9.00 am to 5.00 pm except Saturday and Sunday)

Mode of Payment :- Advance Deposit in State bank of india, MDU Branch, Rohtak -124001, BSR Code 0004734 , Bank Account Number :- 10222170443.

Wednesday, November 19, 2008

State Bank of India (Software/Utility/Salary/Loan File Creator)

In case your bank account with the State Bank of India and you have lot of entries (such as salary/loan etc.) which will be credited in respective bank accounts. Bank requires data on C.D. or on Pen Drive to credit the amount in particular accounts. The following utility will help you to prepare the data file for uploading with State Bank of India.

Instructions for Installation is as below:-

1) Download utility. (Latest Updated)

2) Install sbi_upload.exe file in Destination Folder c:\

3) A Shortcut to SBI will appear on your Desktop, After Installation. If you don't receive shortcut on your desktop , you can create it manually with the help of file = c:\sbi\sbi.exe.

5) Now click on Shortcut available on your desktop, To get it Clear Press Alt+Enter to enlarge the screen.

6) A messeage will be appear that "Do you want to Modify Data=Y or N ", if you press Y than salary data with bank account numbers will be appeared , you can modify here and save through Control+Enter or Control+W. Next screen will appear for Amount debit in Account Number (As per Bank Instruction). Press again Control+Enter or Control+W.

7) Select S for Salary and L for Loan entries.

9) You can submit this file to bank for uploading, your data will be uploaded sucessfully.

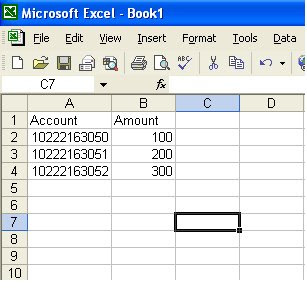

Data.dbf File with the Help of Excel (Instructions are as under)

1. First open Excel and delete sheet2 and sheet3 after that type your data as shown in picture.

2. Select Data which you have typed, Don't Select row and colomn (i.e. A . B and 1,2,3,4) as shown in picutre. Select from Account to 300 (shown in picture.)

2. Select Data which you have typed, Don't Select row and colomn (i.e. A . B and 1,2,3,4) as shown in picutre. Select from Account to 300 (shown in picture.)

3. Now Save data.dbf file in location c:\sbi\data\data.dbf .

4.Save as type should be DBF4 (Dbase 4)

5. Press yes button When asked.

Overall ,if you want to directly enter data through this software , you can download data.dbf file from below and place it in \sbi\data\data.dbf and feed your data as you want to upload in bank.

--------------------------------------------------

Requirement of Data base file (DBF) file of your account statement with State Bank of India for Bank Reconcliation,

In case if you have bulk entries in your account with state bank of India, and you are in need of dbf file for Bank Reconciliation. It is possible. Please email at the following address

rkj_zen@yahoo.co.in

Dbf file solution will be provided .

Date Sheet of Exams Dec. 2008 (Maharishi Dayanand University , Rohtak)

Tuesday, November 18, 2008

Revised List of Approved Hospitals in Haryana State

Monday, November 17, 2008

Notification of Mercychance for 2008-2009 (Maharishi Dayanand University, Rohtak)

their last admissible chance in the year 2000 onwards, as under:--

i) For improvement of result/ score in the courses where the provision of improvement

exits. The students may appear in one or more theory paper(s) as explained in the

relevant Ordinance.

ii) For clearing the re-appear compartment paper(s) only in the cases where the students

have not been able to clear the same within the stipulated chances.

iii) The mercy chance will not be applicable in the case of students of

MBBS/BDS/BAMS/BHMS courses.

iv) The students will have to appear according the latest syllabi applicable for the session

2008-09. However, the students of MA/M.Sc/M.Com Courses who appeared/passed

their exams. under old scheme of 800/900/1000 marks during the session 2002-04

may appear according to that scheme/syllabi.

The examination fee for this mercy chance is prescribed as under:

i) UG Curses Rs.1,500/-(each exam. form)

ii) PG Courses Rs.2,000/-(each exam. form)

iii) All Professional Courses Rs.5,000/-(each exam. form)

Accordingly the schedule of examination for the above said candidates is notified as available in Download Notification

The students who have already appeared in their higher examination and their result has

been cancelled/withheld due to non passing of the lower examination, should contact the

concerned Result Branch to know their result of higher examination. Such students, if they

are availing the mercy chance for clearing the lower examination may also appear in the

higher examination for clearing the compartment/re-appear papers, if any, simultaneously.

Controller of Exams.

Sunday, November 16, 2008

Allocation of waiting list candidates for appointment to the post of Tax Assistant

Tuesday, November 11, 2008

Allocation of waiting list candidates for appointment to the post of Tax Assistant

Saturday, November 8, 2008

Drivers of Computer , Java etc

Dear Friend

Now you have not need to go anywhere, most of all drivers will be available only after registraton. register yourself and get any driver

Download , H.P. , Ghost11 with UltraISO

Winamp (All Versions), VLC(Multi Media)

Friday, November 7, 2008

Benefit of Download Our Tool Bar,Radio Hindi Songs, Toolbar

If you still have not download our toolbar , Download our toolbar immediately, Benefit of our Tool Bar is as under

Click Here to Download Our Toolbar

- You can hear Hindi or other Languages songs thruogh our toolbar. Click between of radio and search your F.M. or other stations as you like and select them , then click on play . Now you can enjoy it during working at computer.

- No need to remember site name . Simple click on Magic Free Software and enter your site.

- Google search is also available in it.

- Our site Posts(Archives) are directly added in the toolbar

- You can know the I.P. address of your computer with the help of toolbar.

- You can Group chat with the help of toolbar

- Email notifier is also availble in it. As you receive any mail , your computer will automatically inform you that new mail has been received in your inbox.

- Your city Temperature can also be checked with the help of tool bar

- Clock (Current time) is also available in it.

- Commonly used Email Server links are also available in it.

- Banking Links are available in it. You can watch your account balance here after getting user id and password from your bank.

Interest Rate of Banks

- Allhabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of Rajasthan

- Canara Bank

- Central Bank of India

- Dena Bank

- HDFC Bank

- ICICI Bank

- Indian Bank

- Indus Bank

- J & K Bank

- OBC Bank

- Punjab National Bank

- Punjab & Sindh Bank

- Reserve Bank of India

- State Bank of Bikaner & Jaipur

- State Bank of India

- State Bank of Patiala

- Syndicate Bank

- UCO Bank

- Union Bank of India

Thursday, November 6, 2008

100% Sucessful (Free Mobile Calls through Computer)

You know you can send unlimited FREE SMS, earn FREE Calling Minutes and download Free content just by being the part of the café in the link below

http://cafe.ibibo.com/Dashboard/Dashboard.aspx?cuserId=

d7eb08bb-ed2e-4241-80b4-507b55cfeb87%2526CFF%253Dtrue

%2526uname%253DRAJIV+JAIN

You need to sign in or Sign up. Once done you can invite your friends and earn free calling minutes. Each Invite gives you 3 min free Call time.

Let’s get connected!!!

Cheers!

Tuesday, November 4, 2008

CBDT has issued a new Form of report for claiming deduction u/s 80-IB(11C)

Option Form for the Steno Grade – III in the CBDT

Monday, November 3, 2008

Online Income Tax Calculator A.Y. 2009-10

Online Income Tax Calculator A.Y. 2009-2010

Jobs In Kurukshetra University in Kurukshetra

Sunday, November 2, 2008

Live T.V in Our Tool Bar

Wednesday, October 29, 2008

Monday, October 27, 2008

300 Post in Oriental Bank of Commerce, (OBC) Probationeary Officers

(A Government of India Undertaking)

Head Office, Harsha Bhawan, E-Block,

Connaught Place, New Delhi – 110001

www.obcindia.com

Oriental Bank of Commerce (OBC), a leading public sector bank invites application from Indian citizens for 300 posts of Probationary Officers.

Probationary (JMGS-I): 300 posts

Pay Scale: Rs.10000-18240/-

Age: Min - 18 years, Max - 30 years

Qualification: Minimum 60% marks for Science graduates (55 % for SC/ST/PWD) & 55% for graduates in other streams (50% for SC/ST/PWD) in aggregate from a recognised University or any equivalent qualification recognised as such by the Government of India.

Selection Procedure: The selection will be on the basis of written test and interview. All eligible candidates will be calledfor a written examination which will be both Objective and Descriptive in nature.

Opening of Online submission of Applications: 10th October, 2008

Last date for Online Submission of application: 3rd November, 2008

Data Share more than 10 Mb to 200 Mb

Sunday, October 26, 2008

Email Servers and Banking Sites are Added in ToolBar

If you have not downloaded our toolbar, Draw your attention , the following email servers and internet banking servers have also been inclueded in OUR TOOLBAR. So Download our Toolbar complete free and Use its Features free.

Emails Servers

Bsnl

Dataone

Gmail

Hotmail

Portal Bsnl

Rediffmail

Sify

Yahoo

Internet Banking Servers

Allhabad Bank

Andhra Bank

Axis Bank

Bank of Baroda

Bank of Rajasthan

Canara Bank

Central Bank of India

Dena Bank

HDFC Bank

ICICI Bank

Indian Bank

Indus Bank

J & K Bank

OBC Bank

Punjab National Bank

Punjab & Sindh Bank

Reserve Bank of India

State Bank of Bikaner & Jaipur

State Bank of India

State Bank of Patiala

Syndicate Bank

UCO Bank

Union Bank of India

Thursday, October 23, 2008

Currency Converter Calculator (Completely Free)

Currency Converter Calculator(Free) Here

Tuesday, October 21, 2008

Graduate Apitutude Test in Engineering (GATE-2009)

GATE - 2009 (Graduate Aptitute Text in Engineering) Date of the examination: 08th February 2009 - Sunday (9.30 am to 12.30 pm) 1. General Information Graduate Aptitude Test in Engineering (GATE) is an all India examination administered and conducted jointly by the Indian Institute of Science and seven Indian Institute of Technology on behalf of the National Coordinating Board - GATE, Department of Education, Ministry of Human Resources Development (MHRD), Government of India. The GATE committee, which comprises representatives from the administering institutes, is the sole authority for regulating the examination and declaring the results. GATE is conducted through the constitution of eight zones. The zones and the corresponding administrative institutes are:

Monday, October 20, 2008

Check yourself your TDS return Status

Inconsistencies in the TDS/TCS return filed.

1. How are the inconsistencies identified?

When you file your TDS/TCS return, first the details regarding deposit of TDS/TCS made by you is compared with the data given by banks. The data is uploaded by banks on the basis of the TDS/TCS challans received by them. For this purpose, the Challan Identification Number (CIN), TAN and TDS amount as given in your TDS/TCS return is compared with the corresponding details given in the challan details provided by the bank that has accepted the tax. (CIN consists of the BSR code of the branch where you deposited the tax, date on which you deposited tax and the challan serial number which have been stamped on the counter foil of the challan given to you.)

Once these are matched, the PAN ledger of each deductee is credited with the TDS/TCS as provided in your return provided the PANs of the deductees have been given by you in the return.

2. What are the kinds of inconsistency status provided ?

Matched : If all the CIN details in the TDS/TCS return match with the corresponding details provided by the banks, the challan is shown as matched as the payment claimed to have been made by you is also validated by the bank

Match Failed : In this case CIN given in your TDS/ TCS return is found in the bank data. But the TAN and / or amount as given in your return against this CIN do not match with the TAN and / or amount given against this challan by the bank.

Match Pending : In this case, the CIN as given in your statement is not available in the CIN details provided by the banks.

Count of Missing deductee PAN : If you have not provided the PAN details of some of your deductees, the count of such cases is provided.

Count if deductee PAN not present in ITD database : If some of the deductee PAN provided by you are not present in Income Tax Department (ITD) database, the count of such cases is provided.

3. What could be the possible impact of these inconsistencies?

In case of inconsistency, there would be no posting in the PAN ledger of the deductee with the amount of tax deducted/tax collected on his behalf. He may, therefore, have difficulty in proving the TDS /TCS claimed by him in his income tax return

If challans claimed in the TDS/TCS returns could not be matched completely with the data given by the banks, you may have difficulty in proving to your TDS assessing officer that you have actually deposited the TDS/TCS deducted by you.

4. How can I get more details with respect to inconsistencies in my TDS return?

You can access TIN web-site (http://www.tin-nsdl.com/ ). Click on the link “Quarterly Statement Status” and then provide your TAN and the Provisional Receipt Number (PRN) of the return to get more details about your returns

In case of match pending cases, compare the CIN as shown in the Quarterly Status Statement (what you have provided in the return) with the CIN as given in Challan Status Inquiry (CIN as given by the banks) to identify the mistake.

5. How can I rectify these inconsistencies?

If you have made any mistakes in your TDS/TCS returns you can rectify them by filing a correction statement. Procedure for preparation and filing of return is available in TIN website.

If bank has made any mistake in the amount or name or major head code given by them against your CIN, they can rectify them

If the bank has made any mistake in TAN or CIN you will have to contact your TDS Assessing Officers

If bank has not uploaded your challan, then you may request the bank to upload the same.

You can verify the details provided by the banks by using the “Challan Status Inquiry” facility available in TIN web-site

6. How can I prevent these inconsistencies in my future return?

1. You should use the same TAN to deposit tax in the bank and to prepare the TDS/TCS statement.

2. In case you have multiple TANs, only one TAN should be used consistently, the other TAN(s) should be surrendered to ITD.

3. The deductor details, i.e. TAN, name, address of deductor should be correctly stated in the statement filed.

4. Challan details (BSR code- 7 digits, challan serial number – upto 5 digits, date of tender) mentioned in the statement should be same as those stamped by the bank on the challan counterfoil. (Verify the challan details from TIN website ( http://www.tin-nsdl.com/) before filing the statement to prevent errors)

5. The challan amount mentioned in the statement should same as the total amount deposited in the bank.

6. Valid 10-digit PAN of deductee should be provided.

Sunday, October 19, 2008

Download (Free) Our Toolbar

Beneifts of Download

Friday, October 17, 2008

Railway Enquires

You can search your Train Destination, Millage, Day Shedule etc. There are so many benefits in below link

Find Your Train , Online Booking

Gayatri Mantar Free Download with Winamp

Now you can download Gayatri Mantar from here and make it as default sound when your computer Starts each and every time.

To Make it Default, Please follow the following procedure.

First download and unzip at your desktop/ your desired location. Then drag the gayatri mantar.mp3 file and go to StartButton>All Programme>Startup>drop the dragged file Here

Download GayatriMantar (File size 368.1 K.b. in Zip Format)

Thursday, October 16, 2008

State Teacher's Eligibility Test-2008 , Result (STE result)

Tuesday, October 14, 2008

Search Name,Address,Phone Number BSNL

if you know any one of the following , you can easily search another things.

1) BSNL Phone number

2) Some/Uncomplete Address

3) Name (may be uncomplete)

Please take help from the bottom of this site http://magicfreesoftware.blogspot.com

Friday, October 10, 2008

2nd Quarter Tds Return Due Date is 15.10.2008

Kind Attention that the due date of your tds return for the 2nd quarter is 15-Oct-2008 for the financial year 2008-09.

Note:- In my experience i have found that there is confusion to make a quarter. It is quite clear that the quarter depends upon your date of booking of expenditure.

example for the same is as under:-

if we pay/book salary on 30/09/2008 and deposit tax(TDS) on 5.10.08, the said entry relates to 2nd quarter. we should not care the tds deposit date.

Thursday, October 2, 2008

Date Sheet and ROLL NUMBER SLIP of MDU Rohtak

You have to fill your Registration Number in White Cell of Excel sheet

Download Roll Number Slip Here (Size 1.48 mb in zip format)

Date Sheet BA/Bcom/Bsc / Purva Madhya, Uttar Madhya, Shastri Supplementry Exam (it may be very time to time.)

Photo have to affixed on the slip.

Instruction for download

- Don't open Excel file oline

- First download and Save on your Desktop or your desired place

- Now open excel file and fill your registraton number in white cell.

- Your Roll Number Slip is ready.

- No limit for downloading Roll number slip after single/one Time download

Wednesday, October 1, 2008

Game, sms , video, film free

Sms & Free Mobile Talk

Completely free sms on Mobile Phone , Click below and register one time and enjoy

IndiaRocks , Ibibo

enjoy

Thanks

DEDUCTION OF TAX AT SOURCE —INCOME–TAX DEDUCTION FROM SALARIES

DEDUCTION OF TAX AT SOURCE —

INCOME–TAX DEDUCTION FROM SALARIES

UNDER SECTION 192 OF THE

INCOME–TAX ACT, 1961

DURING THE FINANCIAL YEAR 2008-2009

CIRCULAR NO. 9 /2008 [F.No.275/192/2008-IT(B)]

NEW DELHI, the 29th September, 2008

Protect Your Computer with Virus and Safe your Data

Format due to virus

virus problem

data loss due to virus

etc.

if you are facing such type of problem and have lost your data, it is very serious when you have no backup of it.

Sollution for this is very simple ,

First create XP-Ghost of your computer when it is running in well condition or after the new installation of windows and all drivers are required by you. After that make DVD of Ghost Image.

Now You are free, When you feel any problem in your computer due to Virus or any other Drivers. You can format your computer , Installation of Windows & all drivers with in 10 mintues with the help of Ghost. (Size 3.16 mb only)

Benefits of Ghost:-

1 No need to call computer engineers

2 Virus problem will be removed permanently

3 No need to handle Driver cd's

4 No need of different type of software for installation, such as MS office, Nero,

Multimedia Player, VGA driver et

if you feel any problem you can take help via email at rkj_zen@yahoo.co.in

Tuesday, September 30, 2008

Sunday, September 28, 2008

Roll Number Slip,Maharishi Dayanand University(MDUR), Rohtak & Bed Result

Roll Number Slip (size 1.74 mb in Zip Format)

---Maharirshi Dayanand University , Bed Result can be checked through below Link

for the financial year 2007-08, Easy to download and Check all subjectwise lists

Result of Bed (1.9 mb file)

Saturday, September 27, 2008

Latest Updated ITR forms & Excel Utility for efilling of Your income Tax Return

Download Return Preparation Software for Assessment Year 2008-09

ITR-1

Excel Utility(Version 1.0)

Updated on (12/08/2008)

MS Excel , itr1 excel guide

ITR-2

Excel Utility(Version 1.0)

Updated on (12/08/2008).

MS Excel , itr2 excel guide

ITR-3

Excel Utility(Version 1.0)

Updated on (12/08/2008).

MS Excel, itr3 excel guide

ITR-4

Excel Utility (Version 1.0)

Updated on (12/08/2008).

MS Excel, itr4 excel guide

ITR-5

Excel Utility (Version 1.0)

Updated on (17/09/2008).

MS Excel , itr5 excel guide

ITR-6

Excel Utility (Version 1.0)

Updated on (17/09/2008).

MS Excel , , itr6 excel guide

ITR-8

Excel Utility (Version 1.0)

Updated on (04/07/2008).

MS Excel, , itr8 excel guide

Download Income Tax Return Forms Notified for AY 2008-09

AY 2008-09 Income Tax Return Forms Notification

AY 2008-09 Income Tax Return Forms Notification under Rule 12

ITR-1 (in Regular Font)

ITR-1 Instructions

For Individuals having Income from Salary & Interest

ITR-1 (in Large Font)

ITR-2

ITR-2 Instructions

For Individuals & HUFs not having Income Business or Professionfrom

ITR-3

ITR-3 Instructions

For Individuals/HUFs being partners in firms and not carrying out business or profession under any proprietorship

ITR-4

ITR-4 Instructions

For Individuals & HUFs having income from a proprietory business or profession

ITR-5

ITR-5 Instructions

For firms, AOPs and BOIs

ITR-6

ITR-6 Instructions

For Companies other than companies claiming exemption under section 11

ITR-7

ITR-7 Instructions

For persons including companies required to furnish return under section 139(4A) or section 139(4B) or section 13(4C) or section 139(4D). (Not available for e-Filing)

ITR-8

ITR-8 Instructions

Return for Fringe Benefits

Download Here

ITR1, ITR2 ,ITR3, ITR4, ITR5, ITR6, ITR8

Friday, September 26, 2008

Med Couselling w.e.f. 27.9.2008, Maharshi Dayanand University, Rohtak

Counselling Shedule Starts From 27.09.2008

Return to Home

Urgent E-filling of your Income Tax Return

FaQ (Frequently Asked Question/Answers)

(if you are facing problem in downloading from income tax site due to heavy rush, you can download all itr form through this Site,

after download & Install Free toolbar ,your problem wil be solved automatically.)

Now-a-days efilling is very emportant, if you have still not submit your return, Please hurry, Don't waste you time, and submitt your return immediately. The procedure for efilling is given as under:-

i) first of all you should register your self at income tax site (Click for registration/Login), if you are not aleady member of this site.

for registration click on register button and fill your information,

(Note :- if you are individual and already member, your user name has been changed by income tax department to your pan number )

2) after registration and login you will be able to download all itr forms (Excel utility) . Download your suitable form and fill.

Note:- If you want to download the ITR utility without any registration you can download it Here

While opening your itr excel utility , you will receive a message that enable macro/disable macro, click on enable macro.

Careful:- your macro security should be medium , if you are not getting macro message , you should do as under

in M.S. Office Excel ->click tool->option->macro security->medium.

after complition of your form, you have to click on generate button, if there is any error it will display otherwise, an html file will be generated in the same location where your itr excel utility is available.

Now simple , login at here and click submit your return, select the html file in source and submit. your return will be uploaded , and itr-5 as receipt of submittion will be available at your email id or under Myaccount- myreturn -> select proper assessment year and get your itr-5.

Due date for filing I-T returns for AY 2008-09 by Corporates and other taxpayers where accounts have to be audited under Sec 44AB is September 30th this year. Please do not wait till last moment to file your e-returns - E-File NOW! .

For a smooth E-filing experience please observe the following.

1. Completely prepare your return and generate xml and keep ready.

2. Login only when you are ready to upload your return.

3. At the time of login, do not, repeatedly click on the 'Login' button. Please wait till your first login request is accepted.

4. After login please click on submit your return and upload the xml file.

5. Please download your ITR-V from My Account-> My Return link or wait for ITR-V to be received via email.

6. Please immediately logout and close your browser. This will enable other users to login and submit their returns.

More over- if you fill any problem in downloading or uploading you may contact at 09896124627

Result of BCA (Regular & DDE) July, 2008 Exam.

Result of BCA (Regular & DDE) July, 2008 Exam.